June Market Update

What can fairy tales tell us about investing in today’s markets?

Fairy tales and fables may be predominantly aimed at children, but they often contain lessons that are relevant to grown-ups. We examine four age-old bedtime stories that hold important truths for investors.

We think of fairy tales as stories for children that warn them of risks and teach them how to navigate the world. But investors can learn from these fables too, from how to protect their investments during difficult times to how to take advantage of opportunities when it makes sense. Fairy tales tend to end on a high note with the immortal phrase, “happily ever after.” We believe this should be the same for investments. Let’s look at today’s investment landscape—through an age-old lens.

The economy: Goldilocks and the Three Bears

“Goldilocks and the Three Bears” is a well-known fairy tale involving a young girl named Goldilocks who comes across an empty house in the woods where she finds three bowls of porridge, three chairs, and three beds. She fell asleep after trying them all, having found one of each item that suited her perfectly. Goldilocks’ tranquil nap ended when the owners, the three bears, came home and she ran away, never to be seen again.

Many are familiar with the term “Goldilocks economy”―it’s used to describe an economic environment that’s “not too hot, not too cold, but just right.” Some investors are using this term to describe the current state of the U.S. economy. While the economy’s recent resilience speaks for itself, we believe investors shouldn’t be complacent; the notion that this “perfect” economy will continue can create surprises if we aren’t careful.

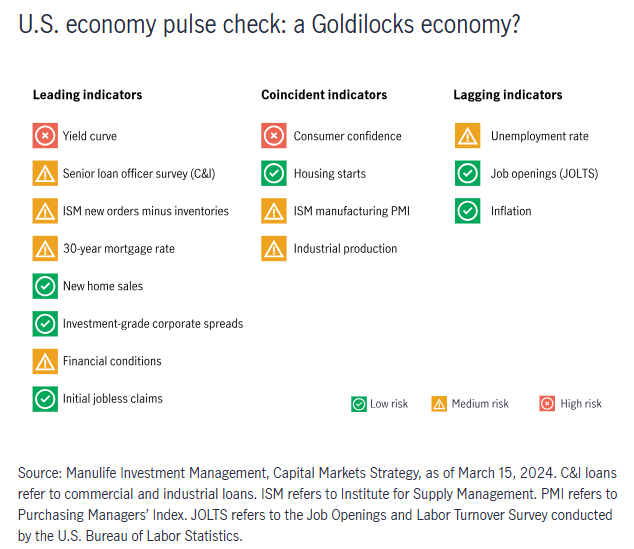

We examine various economic indicators to determine whether a recession may be on the horizon. But instead of focusing on the absolute timing of a recession, we think it’s more important to zero in on the balance of risks facing the economy: Do these indicators point to an increasing risk of recession or otherwise?

When we look at the overall picture, we can see why some investors warmed to the Goldilocks economy narrative: Things seemed “just right” and there’s no clear evidence of either cooling or overheating.

U.S. economy pulse check: a Goldilocks economy?

However, when we dig deeper, we do find that cracks are beginning to show.

For example, while the unemployment rate remains fairly low at 3.9% (as of October 2023), there’s evidence of weakness. Well-known economist Claudia Sahm created a rule to track the risk of a recession based on the unemployment rate. According to her rule, the United States is likely to have slipped into the early stages of a recession when the three-month moving average of the U.S. unemployment rate is 50 basis points or higher than the trough it hit over the previous 12 months. We’re quickly approaching that level.

The Sahm Rule is close to being triggered

U.S. unemployment 3-month moving average relative to 12-month low

While the economy does seem to be on solid footing for now, we need to remind ourselves that, like Goldilocks, this fairy tale might not last forever.

Equities: the Ant and the Grasshopper

“The Ant and the Grasshopper” is a classic fable that contrasts the diligent preparation that an ant’s made for the upcoming winter with the carefree attitude of a grasshopper. The ant spends the summer gathering food while the grasshopper sings and plays. When winter arrives, the ant is prepared but the grasshopper suffers due to lack of food. The story teaches the importance of hard work and foresight.

We’re seeing some similarities between this fable and the existing backdrop for equity investing. In our view, we’re likely nearing the end of the current economic cycle where global growth is likely to disappoint moving forward. We draw comparisons between the winter in the fable and economic slowdown in investing. At this point, investors should be more ant-like and work harder to prepare for the onset of winter.

Moving forward, we expect to see a wide disparity between company earnings. In our view, cyclical companies are likely to face earning challenges. We believe investors who focus on quality factors such as return on invested capital, return on equity, strong recurring cash flows, and stable margins are likely to be rewarded. These factors have done well recently and likely will continue.

What does the earnings environment look like going forward?

Generally, global equity markets have rewarded investors over the past couple of years and valuations are no longer as attractive as they once were. In many parts of the world, valuations on equity indexes are now either near or above their long-term historical averages.

Global equities: valuation has moved higher in most markets

Railing price-to-earnings ratios (last 20 years)

This doesn’t mean that attractive opportunities can’t be found, but as we inch closer to the end of the cycle, investors―much like the ant―will have to work harder to uncover opportunities given the earnings and valuations backdrop. Like the fable, those investors willing to put in the work early are likely to benefit when the winter/slowdown arrives.

Fixed income: the Three Little Pigs

The "Three Little Pigs,” as many of us know, tells the story of three pigs that have each built a house out of different materials (straw, sticks, and bricks) to protect themselves from a wolf determined to blow them down. The story illustrates the need to be patient and the importance of building a house (or an asset) that can withstand the test of time.

We believe this story really lends itself to fixed-income investing, which, for many, hasn’t worked out the way they had expected it to since the end of 2022. While the backdrop of cooling inflation and the expectation of declining interest rates has theoretically set up the case for investing in bonds, the anticipated scenario has yet to play itself out―patience has been necessary. In this context, we find ourselves asking, “how strong is our fixed-income house?”

When we revisited the three phases of fixed-income investing, we outlined how the volatility of the fixed-income market has highlighted the need for active management from a duration perspective, especially in regard to U.S. Treasuries. Changing market expectations of the number of interest-rate cuts we could expect from the U.S. Federal Reserve (Fed), along with the potential for a soft landing for the U.S. economy, have created a level of volatility in the bond market not seen since the great financial crisis.

Bond market volatility has eased but remains elevated

In addition, spreads for U.S. investment-grade bonds and high-yield credit remain extremely tight, which suggests much of the broader opportunity in these asset classes has played out. Given the tightening in spreads over the last year or so, returns have been very strong in lower-quality credit. Investors need to be mindful that perhaps much of the opportunity set within that segment may be behind us, as spreads are nearing all-time tight levels.

High-yield credit spreads aren’t pricing recession risks

However, as also mentioned in our recent article on fixed income, “yields across different fixed-income asset classes remain historically elevated and the average price for these assets remains well below par (typically $100).” What this means is that there remain pockets of opportunities, but investors need to be more diligent to uncover them. Prudent, patient fixed-income investors who build their portfolio out of the best material are more likely to see their hard work pay off.

The Fed: the Goose that Laid the Golden Egg

“The Goose that Laid the Golden Egg” is a classic fable that tells the story of a poor farmer who discovered that one of his geese laid eggs made of solid gold. Initially overjoyed, the farmer became greedy and killed the goose to access all its golden eggs at once only to find that there weren’t any. The tale warns against greed and, crucially, the dangers of seeking immediate gratification at the expense of long-term sustainability.

We believe that there are similarities between this fable and investors’ focus on the Fed’s interest-rate policy. Investors have been waiting for the Fed to start cutting interest rates in the belief that lower interest rates would drive the markets even higher.

We looked at the previous nine easing cycles (dating back to 1970) and calculated the one- and two-year forward returns for various asset classes from the first rate cut of each cycle. Generally, investors were rewarded in both time frames. That said, certain assets, including those represented by the Russell 2000 Index, the U.S. High Yield Index, and the Russell Midcap Index, posted strong gains in the second year while experiencing choppiness in the first year

How risk assets performed after the Fed cut rates

Previous nine easing cycles―since 1970

Overall, it’s fair to say that the Fed’s rate-easing cycles were in sync with the flow of the natural economic cycle with 2001 and 2007 being exceptions. That said, the circumstances in 2007 and 2001 were unique: In 2001, the context around the Fed’s rate cuts included a stock market bubble, a recession, and 9/11; in 2007, the backdrop was framed by the global financial crisis.

2-year CAGR forward returns after the Fed began its easing cycle

Today, our base case is that the Fed will likely cut rates later in the year amid what we believe to be a traditional economic cycle. Against that backdrop, investors’ returns will likely be positive moving forward; however, if something unexpected emerges, investors would be better served not to be greedy and proceed with care.

Ultimately, fairy tales are just stories, but it’s the meaning behind these stories that matters. The lessons contained within these stories can be applied in many ways and aren’t just for children; we believe that these lessons can be applied in investments as well. Hopefully, these fairy tales can help pave the way to investing happily ever after.

Important disclosures

Investing involves risks, including the potential loss of principal. Financial markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. These risks are magnified for investments made in emerging markets. Currency risk is the risk that fluctuations in exchange rates may adversely affect the value of a portfolio’s investments.

The information provided does not take into account the suitability, investment objectives, financial situation, or particular needs of any specific person. You should consider the suitability of any type of investment for your circumstances and, if necessary, seek professional advice.

This material is intended for the exclusive use of recipients in jurisdictions who are allowed to receive the material under their applicable law. The opinions expressed are those of the author(s) and are subject to change without notice. Our investment teams may hold different views and make different investment decisions. These opinions may not necessarily reflect the views of Manulife Investment Management or its affiliates. The information and/or analysis contained in this material has been compiled or arrived at from sources believed to be reliable, but Manulife Investment Management does not make any representation as to their accuracy, correctness, usefulness, or completeness and does not accept liability for any loss arising from the use of the information and/or analysis contained. The information in this material may contain projections or other forward-looking statements regarding future events, targets, management discipline, or other expectations, and is only current as of the date indicated. The information in this document, including statements concerning financial market trends, are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Manulife Investment Management disclaims any responsibility to update such information.

Neither Manulife Investment Management or its affiliates, nor any of their directors, officers or employees shall assume any liability or responsibility for any direct or indirect loss or damage or any other consequence of any person acting or not acting in reliance on the information contained here. All overviews and commentary are intended to be general in nature and for current interest. While helpful, these overviews are no substitute for professional tax, investment or legal advice. Clients should seek professional advice for their particular situation. Neither Manulife, Manulife Investment Management, nor any of their affiliates or representatives is providing tax, investment or legal advice. This material was prepared solely for informational purposes, does not constitute a recommendation, professional advice, an offer or an invitation by or on behalf of Manulife Investment Management to any person to buy or sell any security or adopt any investment strategy, and is no indication of trading intent in any fund or account managed by Manulife Investment Management. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification or asset allocation does not guarantee a profit or protect against the risk of loss in any market. Unless otherwise specified, all data is sourced from Manulife Investment Management. Past performance does not guarantee future results.

Manulife Investment Management

Manulife Investment Management is the brand for the global wealth and asset management segment of Manulife Financial Corporation. Our mission is to make decisions easier and lives better by empowering investors for a better tomorrow. Serving more than 17 million individuals, institutions, and retirement plan members, we believe our global reach, complementary businesses, and the strength of our parent company position us to help investors capitalize on today’s emerging global trends. We provide our clients access to public and private investment solutions across equities, fixed income, multi-asset, alternative, and sustainability-linked strategies, such as natural capital, to help them make more informed financial decisions and achieve their investment objectives. Not all offerings are available in all jurisdictions. For additional information, please visit manulifeim.com.

This material has not been reviewed by, is not registered with any securities or other regulatory authority, and may, where appropriate, be distributed by the following Manulife entities in their respective jurisdictions. Additional information about Manulife Investment Management may be found at manulifeim.com/institutional

Australia: Manulife Investment Management Timberland and Agriculture (Australasia) Pty Ltd, Manulife Investment Management (Hong Kong) Limited. Canada: Manulife Investment Management Limited, Manulife Investment Management Distributors Inc., Manulife Investment Management (North America) Limited, Manulife Investment Management Private Markets (Canada) Corp. Mainland China: Manulife Overseas Investment Fund Management (Shanghai) Limited Company. European Economic Area Manulife Investment Management (Ireland) Ltd. which is authorised and regulated by the Central Bank of Ireland Hong Kong: Manulife Investment Management (Hong Kong) Limited. Indonesia: PT Manulife Aset Manajemen Indonesia. Japan: Manulife Investment Management (Japan) Limited. Malaysia: Manulife Investment Management (M) Berhad 200801033087 (834424-U) Philippines: Manulife Investment Management and Trust Corporation. Singapore: Manulife Investment Management (Singapore) Pte. Ltd. (Company Registration No. 200709952G) South Korea: Manulife Investment Management (Hong Kong) Limited. Switzerland: Manulife IM (Switzerland) LLC. Taiwan: Manulife Investment Management (Taiwan) Co. Ltd. United Kingdom: Manulife Investment Management (Europe) Ltd. which is authorised and regulated by the Financial Conduct Authority United States: John Hancock Investment Management LLC, Manulife Investment Management (US) LLC, Manulife Investment Management Private Markets (US) LLC and Manulife Investment Management Timberland and Agriculture Inc. Vietnam: Manulife Investment Fund Management (Vietnam) Company Limited.

Manulife, Manulife Investment Management, Stylized M Design, and Manulife Investment Management & Stylized M Design are trademarks of The Manufacturers Life Insurance Company and are used by it, and by its affiliates under license.